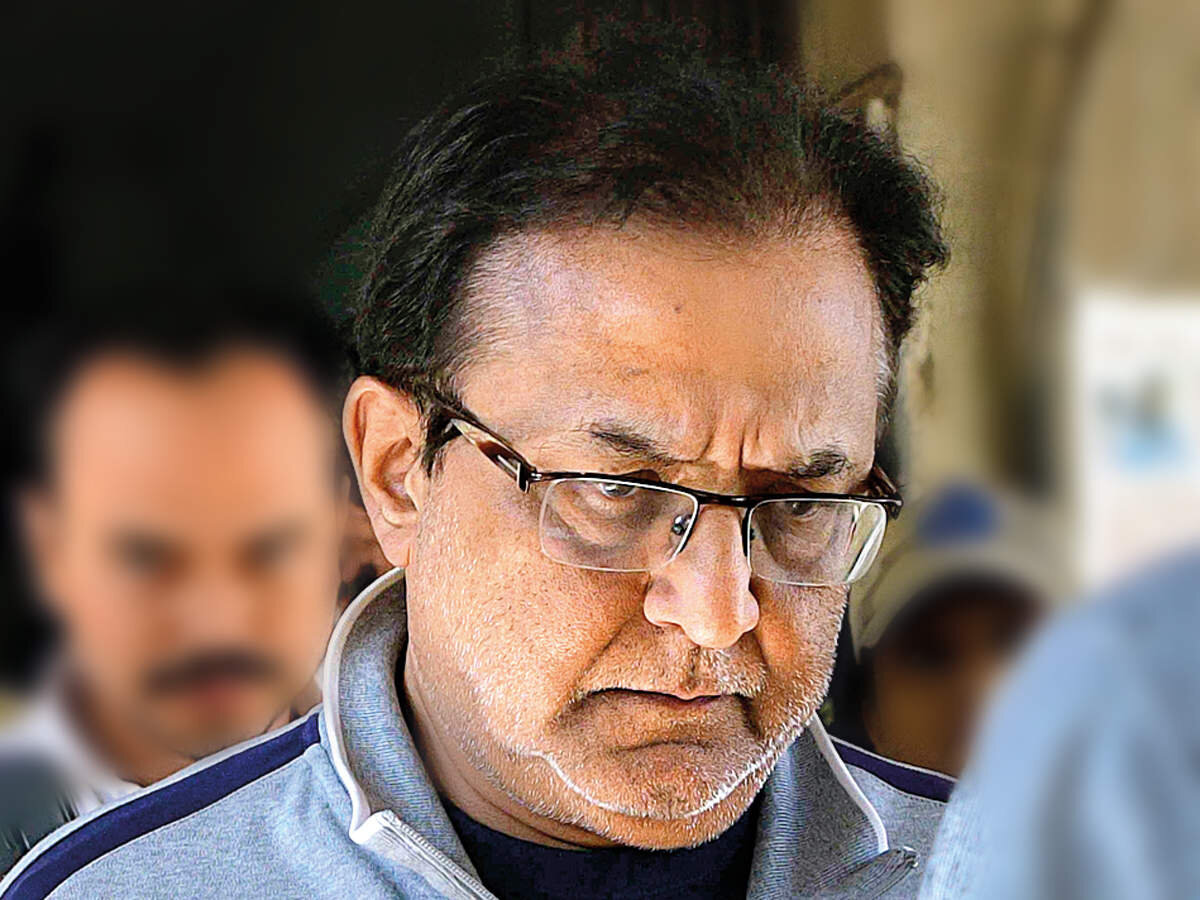

DHFL broke its own rules to loan Rana Kapoor's firm Rs 300 crore: ED

Charge sheet says DHFL gave the loan on receipt of a letter from Kapoor’s daughter, without the sanction of its own finance committee.

Charge sheet says DHFL gave the loan on receipt of a letter from Kapoor’s daughter, without the sanction of its own finance committee.

MUMBAI: The Enforcement Directorate’s (ED) investigation into Yes Bank founder Rana Kapoor’s allegedly suspicious transactions with Dewan Housing Finance Corporation Limited (DHFL) in 2018 has revealed that the firm allegedly gave a Rs-300 crore loan in April 2018 to a Kapoor controlled firm without the required nod from its own finance committee.

The loan - to a firm called DOIT Enterprises (India) Pvt - was in addition to an initial loan of Rs 300 crore sanctioned to it in May 2017 by DHFL’s finance committee as per its procedures. The firm has since been renamed to DOIT Urban Ventures India Pvt Ltd.

In April 2018, the loan amount was increased to Rs 600 crore on the basis of a letter from Radha Kapoor, daughter of Rana and Bindu Kapoor.

“Further in July 2018, both these loan amounts were fully repaid by way of sanctioning and disbursing a new loan of Rs 600 crore to Doit Urban Ventures India Pvt Ltd, that for the loan of Rs 600 crore the formal request had been made by Rana Kapoor only,” the charge sheet said.

Wadhawan told the ED that in April 2018, less than a year after DHFL sanctioned the Rs-300 crore loan, it received a letter from Radha Kapoor, a director of DOIT, requesting it to increase the loan to Rs 600 crore and replace the old security and guarantor with new ones, Wadhawan told the ED.

“On the basis of the said letter, the bridge loan of Rs 300 crore was sanctioned by DHFL to DOIT Urban Ventures (India) Pvt Ltd,” he said. Radha Kapoor and her sisters Rakhee and Roshini each own 33 per cent of DOIT.

The ED charge sheet read, “He [Kapil Wadhawan] further stated that in DHFL there was no specific board-approved policy stating as bridge loan, however, considering the urgent need of the borrower he had sanctioned the bridge loan of Rs 300 crore. The purpose of the bridge loan was general corporate purpose.”

The ED charge sheet said that Wadhawan confirmed to them that under DHFL policy he was not empowered to sanction a loan beyond Rs 100 crore by himself. “However, he did not recollect the exact reason as to why this loan proposal was not sent for sanctioning to the finance committee,” it read.

When the ED asked Bindu Kapoor, also a director of DOIT, to explain her signature on the loan guarantee document, she initially said that she had ‘’no idea” about it. Later, she said she had “never visited the office of Dewan Housing Finance Corporation Ltd, [but] that she had signed the said loan documents as per the directions of her husband, Rana Kapoor, at her home at Samudra Mahal, without going into [their] contents.”

Having taken the cognisance of the charge sheet, which the ED submitted on July 13, the PMLA court will now commence the trial. Mirror contacted Kapoor’s and Wadhawan’s lawyers on Saturday but they declined to comment as the case is in court.

The ED began its money-laundering probe into the case on March 7, based on a first information report from the Central Bureau of Investigation (CBI) registered the same day against 12 people, including Kapoor, his three daughters and his wife, the Wadhawan brothers, and five firms. The ED’s and CBI’s investigations looked into allegations that Kapoor had joined hands with Kapil Wadhawan and others to “extend financial assistance to DHFL in lieu of substantial undue benefit to himself and his family members through companies held by them”. Between April and June 2018, Yes Bank had invested Rs 3,700 crore in short-term debentures of DHFL, it was alleged.

Simultaneously, Wadhawan allegedly paid kickbacks of Rs 600 crore in the garb of loans to DOIT, which is a wholly owned subsidiary of a firm in which Bindu Kapoor is a director and 100 per cent shareholder. The DHFL loan to DOIT was allegedly given on the basis of DOIT’s mortgage of five properties with meagre value that had been converted from agricultural to residential land.

Others named in the ED’s supplementary charge sheet included chartered accountant D Jain, who had told the agency that he gave CA certificates to a DHFL-controlled firm, Belief Realtors Private Limited (BRPL), to comply with the requirements for a Rs 750-crore bank loan. The loan was given for a redevelopment project at Bandra Reclamation that the ED and the CBI are also looking into.