New criteria for NRI status and how income will be taxed in India effective from FY2020-21

Let us have a look at the significant amendments to the criteria determining 'residential status' applicable from April 1, 2020 and onwards

Let us have a look at the significant amendments to the criteria determining 'residential status' applicable from April 1, 2020 and onwards

For non-resident Indians (Indian citizens or Persons of Indian Origin ('PIO') who have been residing outside India), until March 31, 2020, NRIs who visited India could stay in India up to 181 days in a financial year and still could maintain "Non-resident" status in India. The Finance Act, 2020 and the Finance Act 2021 (assented by the President on 28 March 2021) have made far reaching changes regarding the determination of residential status of NRIs for financial year ended March 31, 2021 and March 31, 2022. This change will directly impact the NRI community

Let us have a look at the significant amendments to the criteria determining 'residential status' applicable from April 1, 2020 and onwards.

New rules to determine residential status of NRIs

Till end of FY 2019-20, NRIs (covers Indian citizens and Persons of Indian Origin) included those individuals who visited India for less than 182 days in a financial year. Finance Act 2020 reduced this period to 120 days for all NRIs.

Further, amended section 6 provides that the reduced period of 120 days shall apply, only in cases where the total Indian income (i.e., income accruing in India) of such visiting individuals during the financial year is more than Rs 15 lakh. Accordingly, visiting NRIs whose total income (which is defined as taxable income) in India is up to Rs 15 lakh during the financial year will continue to remain NRIs if the stay does not exceed 181 days, as was the case earlier

As such, besides monitoring the number of days present in India, the visiting Indian is also required to keep tab of his Indian taxable income. This is because once income taxable in India or taxable Indian income exceeds Rs 15 lakh, then provisions related to stay exceeding 120 days, as mentioned above will be applicable

It may be noted that dividends distributed by Indian companies would be taxable in the hands of the shareholders and as such, would form part of the taxable income. On the other hand, since interest on FCNR and NRE deposits are exempt it will not form a part of taxable income. This amendment is effective from financial year 2020-21, viz. April 1, 2020 to March 31, 2021

An NRI, whose taxable income exceeds Rs 15 lakh stays in India for 120 days or more, then such an individual further needs to check whether his stay in India is 365 days or more in the immediately preceding 4 years. Let us assume a non-resident visits India in FY 2020-21 (having taxable income in the financial year exceeding Rs 15 lakh) and stays for say 130 days. Further, during the preceding 4 financial years (i.e., FY2019-20, 2018-19, 2017-18, 2016-17) he was in India for total of 365 days

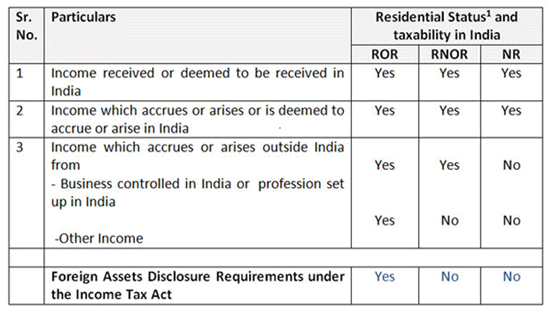

In such a case, he will be treated as a resident individual for income tax purposes. While this may ring alarm bells for many NRIs, but in a relief they will be treated as "Resident but Not Ordinarily Resident (RNOR)". This would be a relief as their foreign income (i.e., income accrued outside India) shall not be taxable in India

RNOR Criteria liberalised

Till and in FY 2019-20, an individual was treated as 'Resident but Not Ordinarily Resident' (RNOR) if any of the following conditions are satisfied:

(a) an individual who has been a non-resident in India in 9 out of 10 previous financial years preceding that year, or

(b) has during the 7 previous years preceding that year been in India for a period of, or periods amounting in all to, 729 days or less.

The above 2 additional conditions have been retained as per the current law. Further, we have noted above that due to the amendment made, an individual whose taxable income exceeds Rs 15 lakh and stays in India for 120 days or more (but less than 182 days) and is treated as a resident individual will still be treated as "Resident but Not Ordinarily Resident (RNOR)".

In case of RNOR individuals, the foreign income (i.e., income accrued outside India) shall not be taxable in India. Foreign sources means income which accrues or arises outside India (except income derived from a business controlled in or a profession set up in India)

Indian Citizens and Global Non-Resident -Deemed Residential Status Relaxed based on Indian income criteria & RNOR Widened

An individual being a citizen of India, shall be deemed to be a resident in India in any previous financial year, if he is not "liable to tax" in any other country or territory by reason of his domicile or residence or any other criteria of similar nature. However, this provision will be applicable only if his total taxable Indian income during the financial year is more than Rs 15 lakh.

Till FY 2019-20, there was no such provision in the Income-tax Act. This provision of determining residential status for a stateless individual shall not be applicable for OCI (Overseas Citizen of India) card holders or foreign citizens

"Liable to Tax" defined by Finance Act 2021

The Finance Act, 2021 has defined this term "Liable to tax" in relation to a person and with reference to a country, means that there is an income-tax liability on such person under the law of that country for the time being in force and shall include a person who has subsequently been exempted from such liability under the law of that country

The above provision has resulted in confusion in case of persons who are residing in Middle Eastern countries which do not impose any income-tax on individuals. As a relief to such NRIs working in such countries, the Central Board of Direct Taxes (CBDT) has issued a press release clarifying that the above provision is an anti-abuse provision and is not intended to tax bonafide workers in foreign countries. It is further clarified that in case a person becomes Resident under this Section 6(1A), no tax will be levied on foreign income unless it is derived from an Indian business or profession.

In most cases, this would not have any direct impact on taxable income in India as the status of such individuals would still be NR or RNOR and only Indian income shall be continued to be taxable in India and not the worldwide income. However, several Indians who are residing outside India are not comfortable with RNOR status. The provision is also counter-productive as it discourages investments in India in shares and other securities, real estate and other income-yielding instruments resulting in taxable income in India

Way forward

NRIs need to carefully consider the total Indian income and plan their travel itinerary based on the amendment for their period of stay. The positive aspect is that in most cases, NRIs can continue to visit India for up to 181 days in the financial year and even in other cases where the period of stay in India is 120 days up to 181 days (and also for 365 days or more in preceding 4 years) or more or in case of Indian citizens who are not tax residents of any other country and are deemed to be tax residents of India, the status would be RNOR (if their Indian Income exceeds INR 15 lakhs) and hence foreign income shall not be taxable in India

https://economictimes.indiatimes.com/wealth/tax/new-criteria-for-nri-status-and-how-income-will-be-taxed-in-india-effective-from-fy2020-21/articleshow/75004572.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst